Opportunity Zones

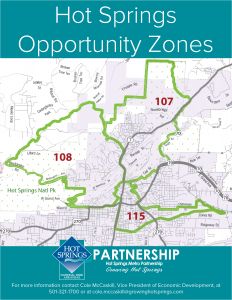

Opportunity Zones are a new federal program created to encourage long-term capital investment in underserved areas. Investors can roll their pretax capital gains into business and commercial real estate investments located in Opportunity Zones and enjoy a myriad of tax benefits that increase with time. Hot Springs has three Opportunity Zones.

On April 17, 2019 the IRS released a second set of guidance on Opportunity Zones since the program was created in December of 2017. This guidance clears up some issues related to using the program for investment, mainly for real estate investing issues that have arisen including clarifying how it will address interim gains, an issue that has until now kept some from moving forward with the program.

Click here for the full 169 page release from the IRS.

Click here for an analysis by Novogradac. Click here for an analysis by Bloomberg and here for a top 20 issues resolved list from Novogradac.